Tokenization Platform

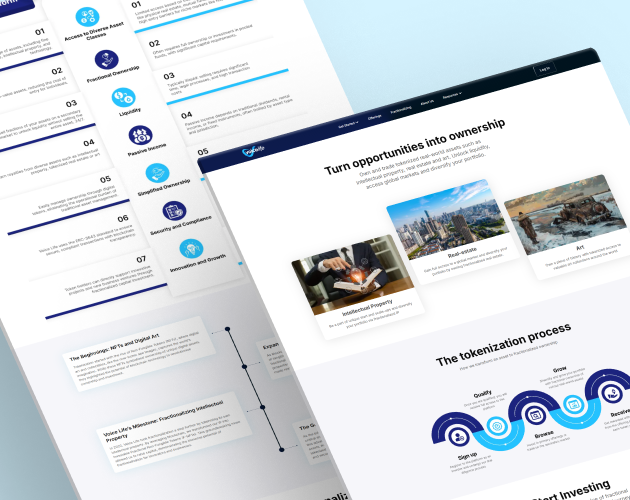

To design a secure and compliant blockchain ecosystem capable of tokenizing real-world assets (RWA) such as real estate, intellectual property, and patents.

The client needed to build a next-generation investment platform to democratize access to high-value assets. The challenge was to create a secure, compliant blockchain ecosystem capable of tokenizing real-world assets (RWA) like real estate, intellectual property, and patents. This required solving complex problems around regulatory compliance, asset valuation, investor verification, and creating a liquid secondary market for traditionally illiquid assets.

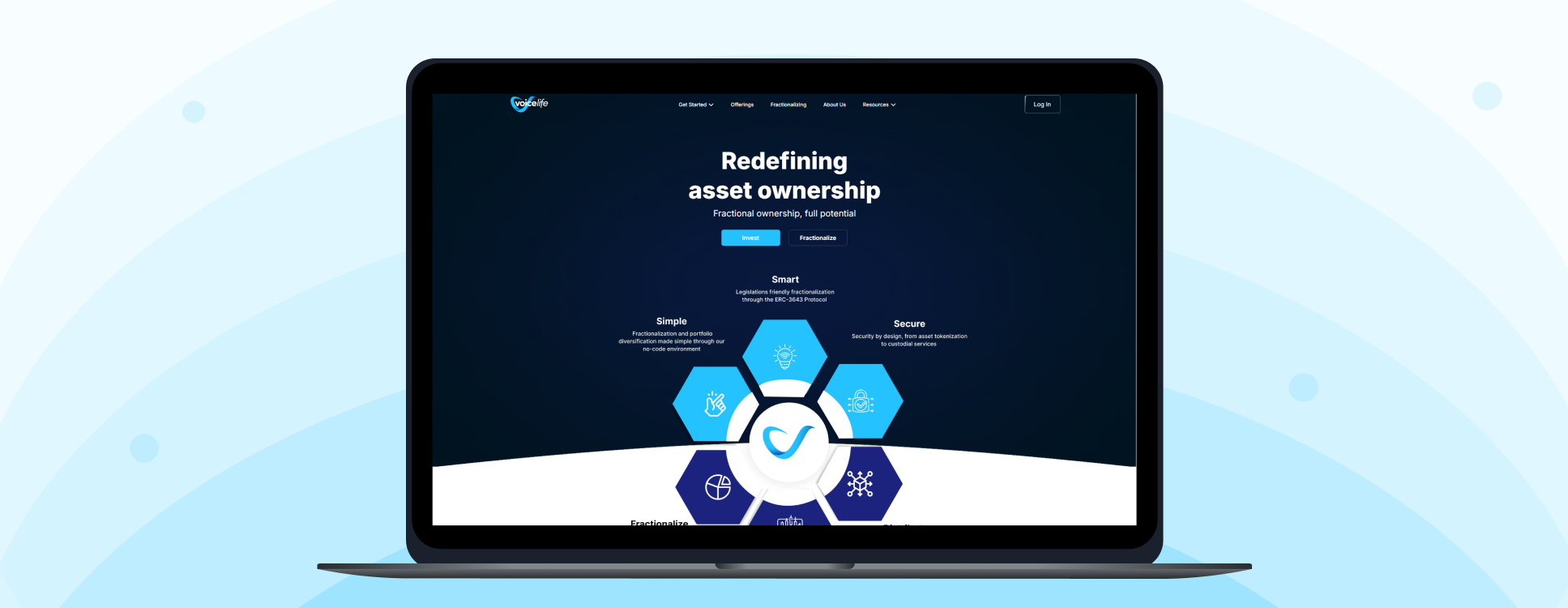

Engineering the Future of Asset Ownership Through Blockchain

We architected a comprehensive tokenization ecosystem that bridges traditional finance with decentralized technology. This platform transforms physical and intangible assets into secure, tradable digital tokens, creating new investment opportunities while maintaining rigorous compliance standards.

Our solution involved building a multi-layered, institutional-grade platform:

- Smart Contract Infrastructure: Developed audited, secure smart contracts on a leading blockchain network to represent asset ownership, manage dividends, and enforce regulatory requirements programmatically.

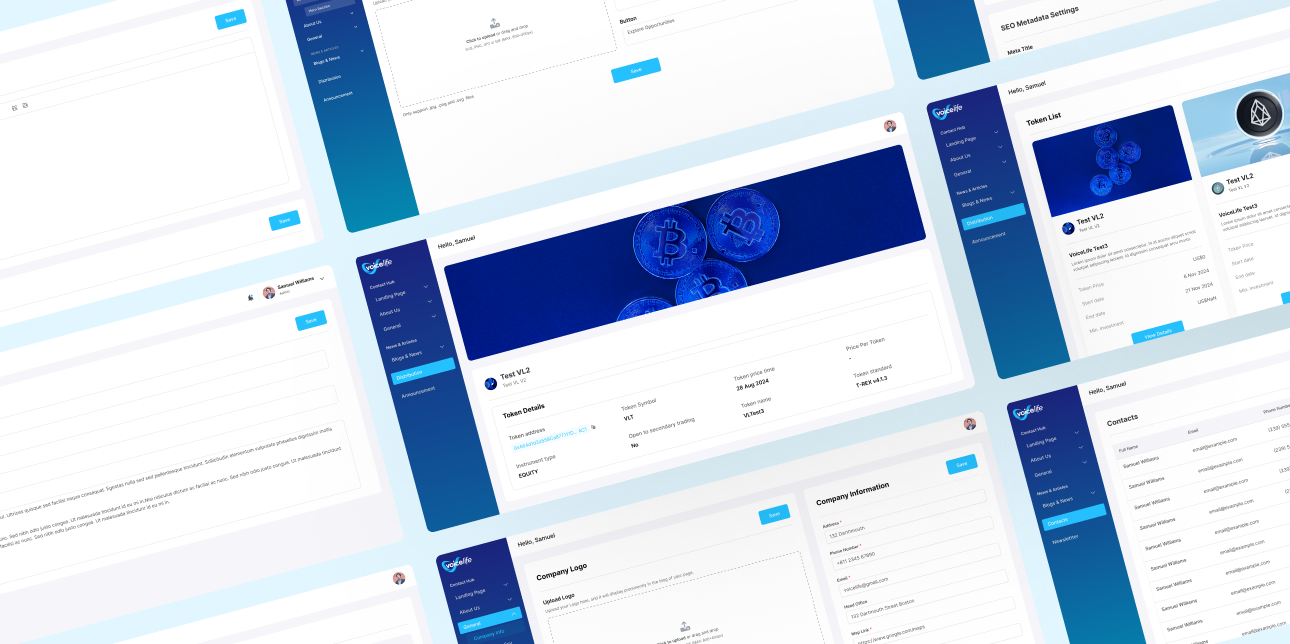

- Asset Tokenization Engine: Built a sophisticated backend system to handle the legal and technical process of minting tokens, including KYC/AML integration, custody solutions, and legal framework compliance for different asset classes.

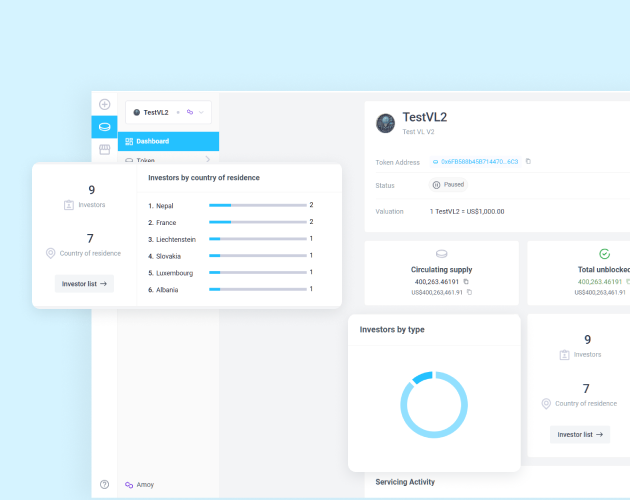

- Investment Dashboard: Created an intuitive frontend interface for investors to browse assets, view performance, and trade tokens on a built-in secondary marketplace with real-time settlement.

- Security & Compliance Layer: Implemented multi-signature wallets, investor accreditation checks, and transaction monitoring to ensure full regulatory compliance across jurisdictions, making the platform suitable for institutional use.

Total asset value successfully tokenized and secured on the platform

Security incidents or smart contract vulnerabilities since launch

Average transaction settlement time vs. weeks in traditional markets

Regulatory compliance across implemented jurisdictions (KYC/AML)